March 23, 2020

The timing of the Article “Are You Prepared? / A Lesson From the Last Crash”, written by Eric S. Smith, J.D. on November 10, 2019, appears to have been clearly “prophetic” in its intended protective effect in view of the current dramatic market conditions.

When this message was first written, toward the end of 2019 and in the first two months of 2020, stock markets were at all-time highs. There was, however, a growing concern that another crash might be coming, but few then could have guessed its current cause and severity. The last crash devastated Taft-Hartley plans and this crash will do so as well. Then as now, the increase in the number of plans that will now be driven down into the DOL’s “red” zone classification will likely be dramatic.

Many fiduciary boards will soon be meeting with their investment consultants, in crisis mode, if they haven’t already done so. They will be looking for concrete steps to demonstrate to their plans’ participants that they are taking responsible action in seeking how best to deal with this dramatic downturn and its likely effect on funding levels.

What could have been done to better prepare, and (not knowing how bad it will ultimately be this time) what still can be done to help to potentially reduce further damage? Changing one thing in your plan’s Investment Policy Statement (“IPS”) might make a big difference. Even with the present continuing uncertainty and dire warnings of future investment losses, it may not be “too late” for some (retirement plan trustees) to benefit from this advice.

November 10, 2019

ARE YOU PREPARED? / A LESSON FROM THE LAST CRASH –

Pension trustees, this message is specifically for you

By Eric S. Smith, J.D.

Stock markets are at all-time highs and there is growing concern that another crash is coming. The last one devastated Union plans. What can be done to better prepare? Changing one thing in your plan’s Investment Policy Statement (“IPS”) might make a big difference.

During the last Crash, some version of this little-noticed restriction on plan money managers in the IPSs of most plans likely worsened plan losses:

“We wish our managers to be fully invested, holding no more than 5% in cash or cash equivalents.”

Take a moment to see if this (or something similar) is in yours.

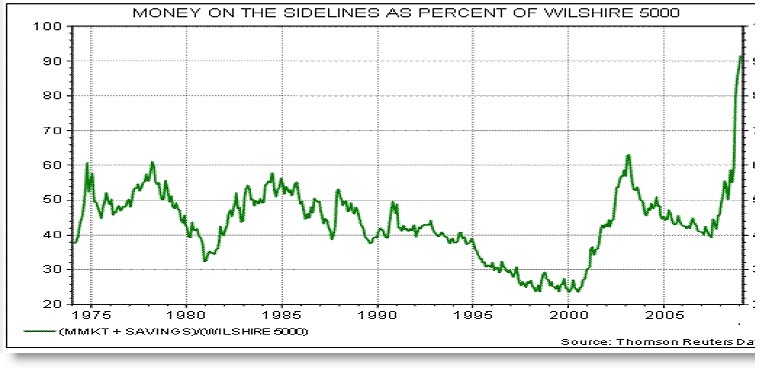

Why is this a problem? Wouldn’t we want our money to be fully invested, earning us a return? In general, yes – that’s exactly what we would want. Holding cash doesn’t generate a return. But, during the 2008/2009 Crash, being fully invested proved to be a serious problem.

This restriction forced investment managers to stay “fully invested” in “a worst in living memory” market. It prevented them from reducing their market exposure and risk. Think of it this way:

You’re on a roller coaster and, after a long climb to the top, you begin to experience a breathtaking drop. You want to get off, but you can’t. You find yourself glued onto the seat, and you’re in for the full ride.

During the Crash, how many times did managers, when reporting huge losses, tell you: “This is the worst market we’ve ever seen. We don’t understand it and we don’t know when it will end.” If you were a trustee during that time, you must remember their expressions of uncertainty and frustration, as well as your own, as you watched the value of your plan’s investments melt away.

Here’s what didn’t make sense. You hired professional money managers to invest your plan’s assets in asset classes in which they are experts. But, when they came to you, as experts, and told you that things have changed – that they were experiencing severe losses in a market that they as experts no longer understood – your IPS made them stay in. To correct this, there’s a simple change you should strongly consider making (consider adding the words in bold):

“While we wish our managers to be fully invested, holding no more than 5% in cash or cash equivalents, during periods of extreme market volatility and uncertainty we will allow our manager to hold up to 30% or more in cash and cash equivalents.”

The exact percentage is not important – the flexibility is. By “untying” your managers’ hands, by giving them the ability to get out with less losses and move to cash, which they can later reinvest at lower prices (“buying low and selling high”), you could help your plan make it through the next downturn with better results than the last one. It’s a small change, but an easy one that you could be very happy that you made.

| Eric Smith, J.D., is also the President of Trustee Empowerment & Protection, Inc., a registered investment adviser, which is providing reviewing consultant services to better protect the trustees of pension and health & welfare plans in their investment-related decision making and to help improve plan investment results. He can be reached at: esmith@TEPI.tech // 248-797-0500. |

© 2019 Eric S. Smith