Decision Technologies Corporation

Trustee Empowerment & Protection, Inc.

March 30, 2020

Report Abstract

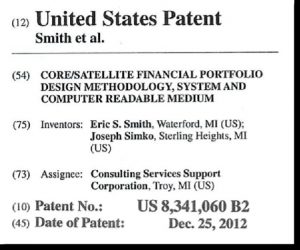

Our patented Core / Satellite strategy was designed to help fine tune overall portfolio risk exposure / volatility – optimizing the portfolio’s risk/return profile.This report provides summary description of the strategy together with the rationales and techniques needed to implement it.

Introduction / Overview

During the 2008 / 2009 Crash we observed that an extraordinarily high number of active managers (far more than usual) had underperformed benchmark indexes in their respective asset classes. As downside volatility surged, the volatility of active managers (the holdings of nearly all of which were more concentrated) proved to be greater than their index benchmarks and they lost more value. Since their greater downmarket volatility seemed to be correlated with greater losses, we wondered if more closely matching index volatilities, but around higher than the benchmark index returns, might produce better investment results in down markets.

Our patented Core / Satellite strategy was the result. It was designed to help fine tune overall portfolio risk exposure / volatilities, in an effort to optimize the portfolio’s risk / return profile, through changing market conditions. The goal: to produce “higher highs” and “higher lows” in comparison with benchmark indices, in both up and down markets, as illustrated in Figure 1.

The success of an 18-month, down market back test of the strategy following the 2008 / 2009 Crash, and the similar (but much more rapid) current market decline, have led us to make knowledge of this strategy and the lessons we learned available.

The “Risk Budget” concept and the practical difference between portfolios “As Designed” and “As Implemented”

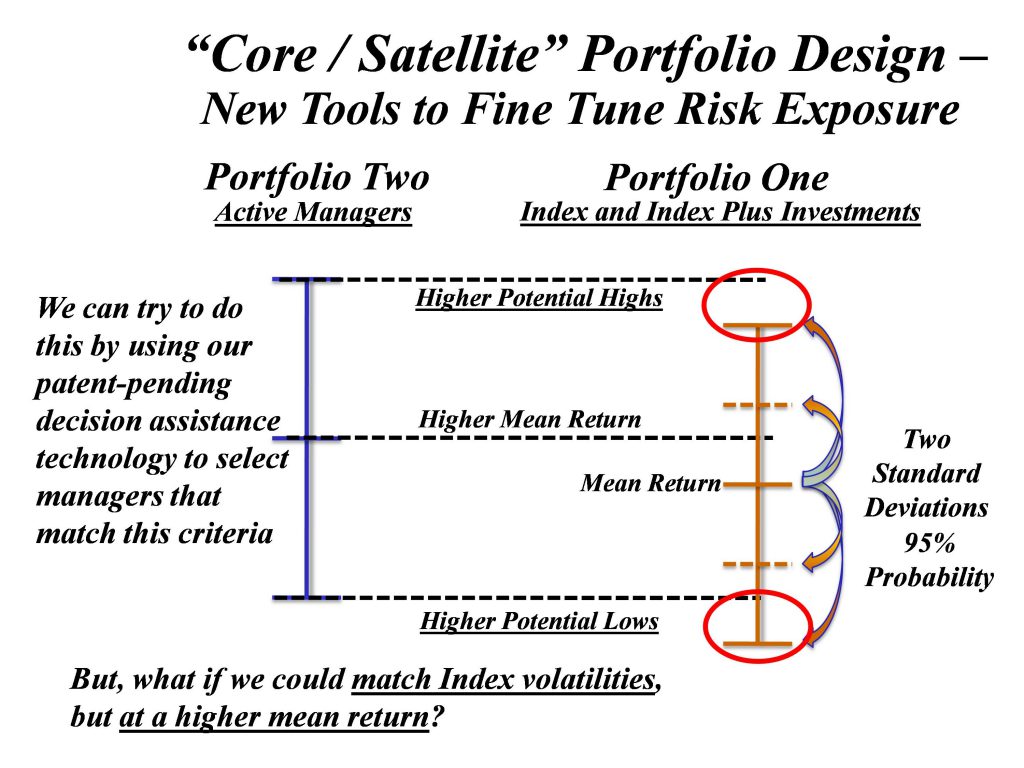

In order to understand the strategy and how we are applying it, you need to understand how manager selection affects the overall risk / return characteristics of investment portfolios – i.e., the difference between portfolios “as designed” and “as implemented.”

As you are likely aware, portfolios are designed by blending various classes of investment assets, in the hope that the blend will produce the highest potential return at an amount of risk within the risk tolerance of the client.[i] The software typically employed to do this makes use of the average returns and volatility (of such returns) of the various asset classes, as well as the historical correlation of the fluctuations in value of such classes relative to each other. It is important to understand that the composite risk exposure of a client’s portfolio, as designed, is the product of the correlation (or lack thereof) of returns and volatility of such returns of the asset classes which make up that portfolio.

But, as implemented, both the composite returns and overall volatility of those returns can, and very often will, be different (possibly much higher or lower) than the theoretical risk / return profile of the portfolio as designed. A portfolio takes its final, implemented form as a result of the selection of mutual funds and/or managers within each of the asset classes comprising the portfolio’s design, and the performance of these managers can vary widely. Some can significantly outperform the benchmark index used to measure performance within the asset class but, much more frequently, actively managed mutual funds and active managers will under perform that benchmark index. Because of this, the manager selection process is a critical part of trying to ensure that portfolio performance is truly being optimized at any given level of risk acceptable to the client.

The volatility of the average returns of each asset class, as embodied by the performance of the index used to represent each such class, effectively defines the “risk budget” of that class.

In our review of large numbers of actively managed institutional portfolios, we found that a large percentage chronically under perform their composite benchmarks. More often than expected, this under performance appeared to have been caused by managers with lower than benchmark index returns and also lower than index volatilities (although sub-par returns and higher than index volatilities were also frequently observed). This appeared especially true in the up-market years preceding the 2008 / 2009 Crash and appears equally true of the most recent up-market period which has just abruptly ended.

Prior to the 2008 / 2009 Crash, we considered this to be the result of flawed manager selection. In such cases, we observed that some managers were not using the full “risk budget” of their respective asset classes. “Risk budget” was defined as the risk exposure a client implicitly accepts by including those asset classes within the client’s portfolio. In other words, these managers appeared to be too conservative and, by investing at a level of risk below that which the client had implicitly accepted, were under performing as a result. Worse yet were under performing portfolios in which managers had produced less than passive index returns, with volatilities higher than their benchmarks.

Prior to the 2008 / 2009 Crash, we focused on developing a decision-assistance technology to enable our advisors to comparatively evaluate hundreds of money managers and thousands of mutual funds. The goal was to enable them to identify which mutual funds and money managers had proven best over time at producing the “composite investment effect” desired by their clients. The resulting technology, for which we were granted a U.S. Patent, uses hierarchically arranged and weighted blends of performance parameters to profile the “composite investment effect” that most closely matches the needs, goals, and preferences of both institutional and individual investors. It worked exceptionally well and permitted the optimization of investment selection in a way never before possible (hence the granting of the Patent).

However, in the run up to the 2008 / 2009 Crash, we observed more weight being placed on return-related factors and less on risk-related factors. This led to the selection of mutual funds and managers with exceptional returns (consistently above benchmark indexes during the extended up-market period) but often with higher than index volatilities. Not surprisingly, when the markets “crashed,” we began to see that managers with lower volatilities were quite often losing less value than their peers and benchmarks. And, even with lower weights placed on risk-related factors, those managers began to rise in the rankings.[ii] The technology worked, but with a lag the length of which was determined by the amount of weight placed upon longer versus shorter-term factors (e.g., 1 year vs. 3 year vs. 5 year average returns). Those with higher weights on shorter-term factors were seeing faster ranking shifts and were able to more quickly adjust to 2008 / 2009 market declines.

Nevertheless, the tendency of clients and their advisors to increase emphasis on return-related factors (in the weightings used) during the pre-Crash up market period, resulted in increased risk, the selection of managers with more “concentrated” holdings, and greater losses. Interestingly, in 2 – 3 standard deviation down market selloffs, index funds appeared to do better than the vast majority of mutual funds and money managers with more concentrated investment holdings. One likely reason is their “broader wingspan” – they’re in literally “everything” within the class.

As market volatility and investor losses surged to unprecedented levels in 2008, we began to focus attention on the following question: “Would it be possible to dampen the downside risk potential of client portfolios without overly constraining the upside potential of the portfolio in the process? The results of this period of study and reflection are described below.

Understanding Our Patented Core / Satellite Methodology

As commonly understood, the “Core / Satellite” investment methodology is typically used by very large funds – often in the tens of billions or more in size. It involves investing in a “passive core” index fund (often the majority of funds within the asset class) with some smaller portion being allocated to one or more active “satellite” investment managers. The reasoning is that it would be very difficult (if not impossible) to place billions of dollars with individual active managers without adversely affecting their ability to effectively deploy such large amounts within their strategies.

Our Core / Satellite Methodology is not designed for such ultra-large investment pools. Instead, it is focused on smaller institutional and individual investment portfolios, from hundreds of millions to as low as tens of thousands. The key difference is that, rather than using a “passive core,” our patented Core / Satellite Methodology uses an “active core.” It was designed to help fine tune portfolio risk exposures without unduly dampening the upside potential of client portfolios, with the goal of producing better results than passive benchmark index-based investments.

To understand this unique strategy and how we are applying it, it is necessary to understand the difference between how we define and select “Core” and “Satellite” managers, and the “investment effect” each selection methodology is designed to produce.

Core Manager Selection: The “investment effect” we desire from a “Core” manager is exposure to the investment potential of the asset class. While using the full “risk budget” inherent in that asset class, we are looking to achieve a higher average return than that of the passive benchmark index. This is the difference between our Core / Satellite strategy and the original passive Core / Satellite strategy.

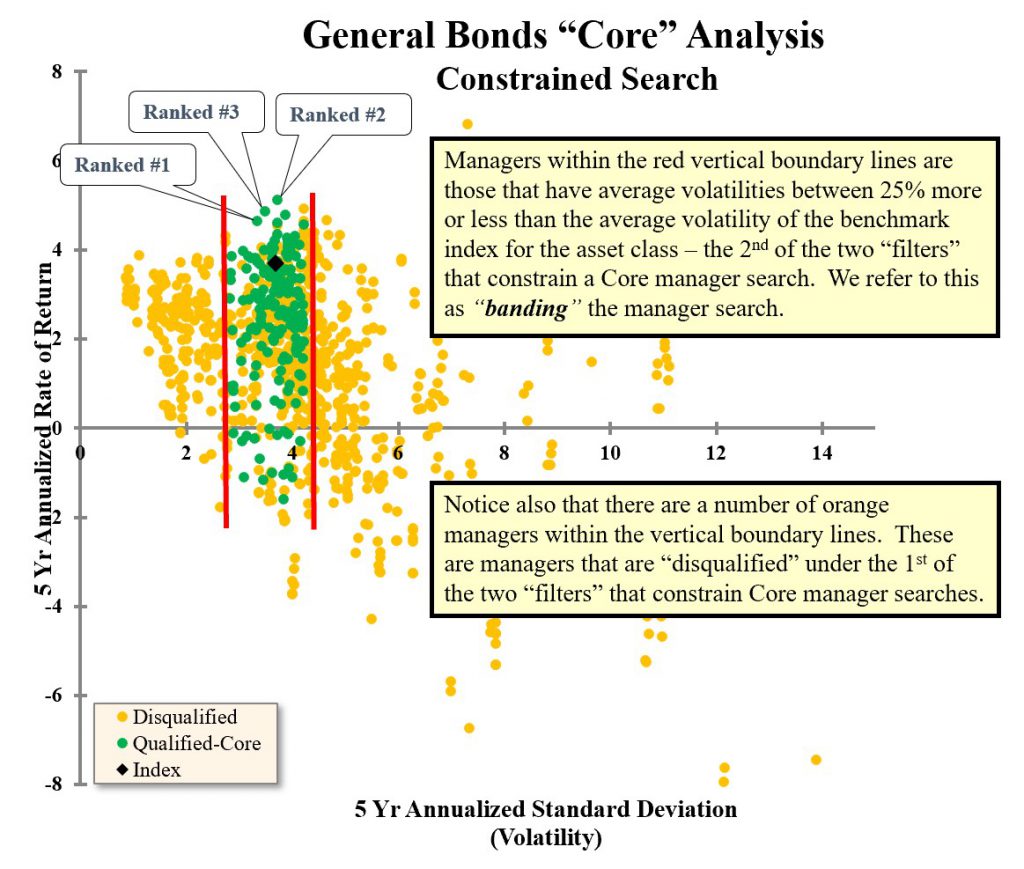

In our methodology, in order to qualify for consideration as a “Core” Manager within any asset class, mutual funds and managers must meet the following two requirements (i.e., Core “filters”):

- They must have an investment style and holdings reasonably consistent with (though not necessarily identical to) that of the benchmark index for the asset class – i.e., “specialty” or narrowly niched/sectored managers would be eliminated from consideration, and

- The historic volatility of such managers must be similar to that of the benchmark index for that asset class – e.g., 25% more or less than the volatility of the benchmark index.

Thus, the search for Core managers will typically be “constrained.” [iii] The universe will be narrowed to managers that vary above or below the volatility of the benchmark by some selected percentage (e.g. plus or minus 25%). After a universe of qualified candidates has been selected, they will be scored and ranked using our patented decision-assistance technology, with a weighted-blend of performance parameters determined by the investment advisor (perhaps with the participation of the client). The goal is the identification of mutual funds or managers that will provide the portfolio with similar volatility / risk exposure, but with potentially better composite performance (including prospects for higher average returns), in comparison with the passive benchmark for that asset class.

Figure 3 represents the General Bond manager universe at around the time of our post-Crash patent application. Here the above two Core “filters” are applied to disqualify more narrowly niched funds as well as funds 25% more or 25% less volatile than the index. Those disqualified are those in orange. The universe of qualified funds are those in green.

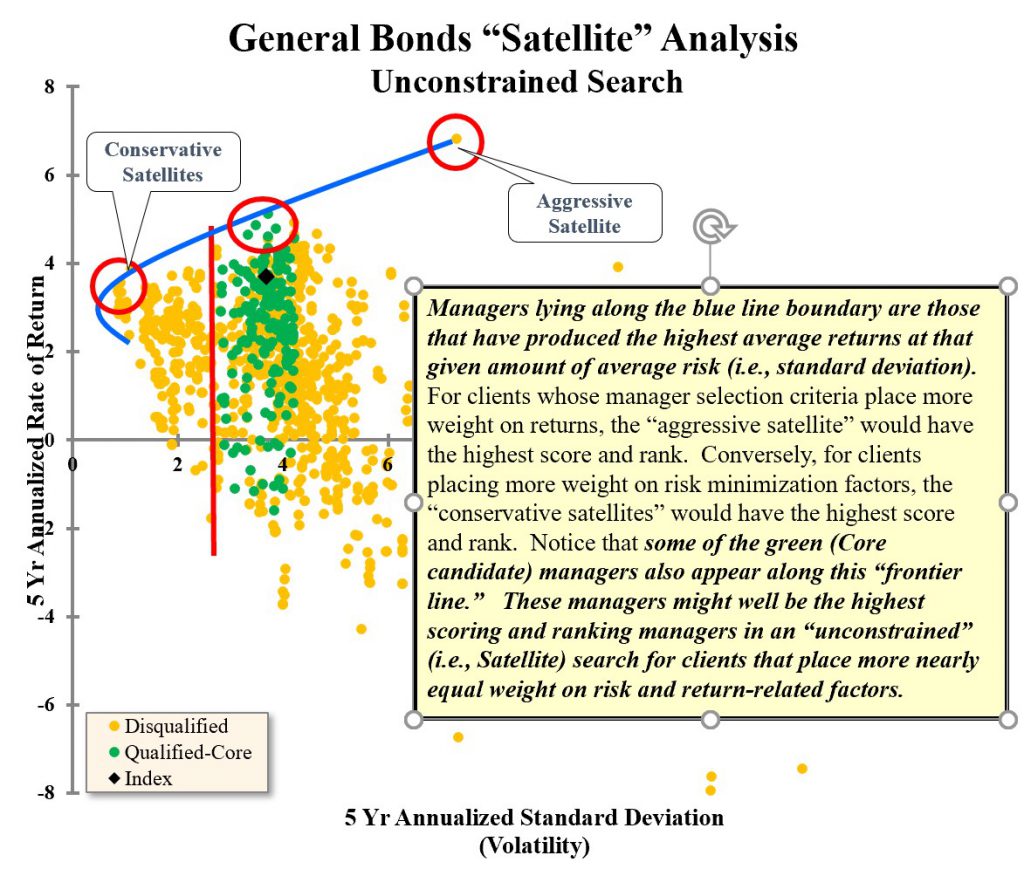

Satellite Manager Selection: In contrast, as shown in Figure 4 below, Satellite managers are selected using broader asset class definitions. This would include (if desired) specialty or narrowly sectored managers that would have been excluded in the Core manager selection process. It would also include managers with volatilities outside of the percentage limitations used in the Core search analysis.

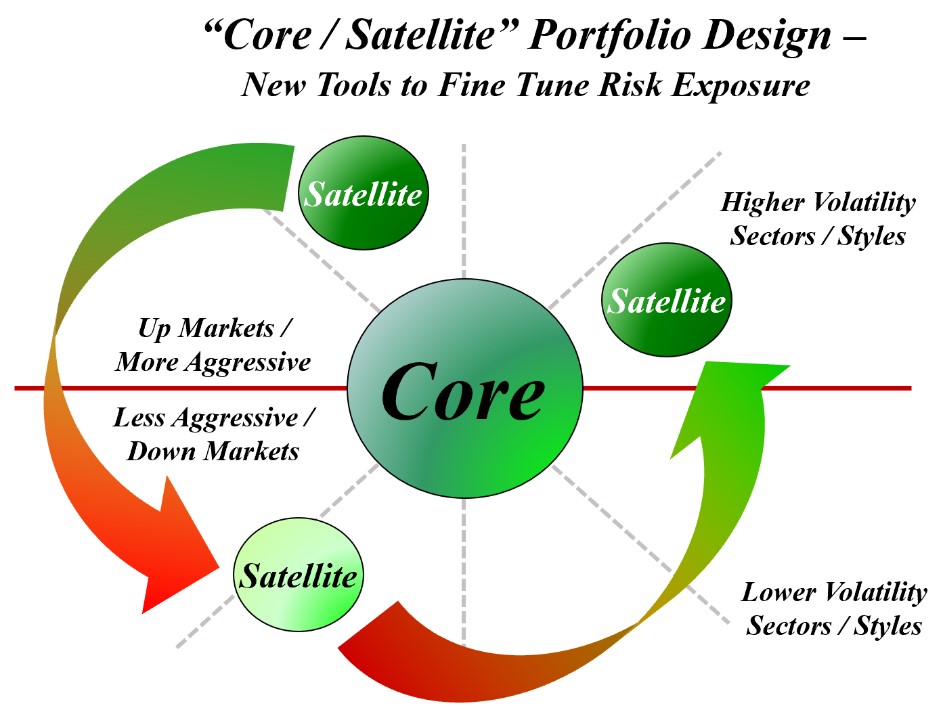

As illustrated in Figure 5 below, the goal in selecting a Satellite manager would be to position some portion of the portfolio to better adapt to and benefit from changing market conditions, by increasing exposure to sectors coming into favor while reducing exposures to sectors that are dropping from favor in the markets.

As can be seen here, Satellites can be either more aggressive than the Core (i.e., have potentially greater volatility and returns) or less aggressive (i.e., with less volatility and possibly less return potential than the Core).

When would a less aggressive Satellite be desirable? The answer is in markets in which downside volatility is increasing (as was the case in the 3rd quarter of 2008) and within the last three weeks of March 2020.

During down market periods, a more conservative Satellite (i.e., a Satellite less aggressive and less volatile than the Core) would tend to lose less money than the Core. And, during such periods, having one or more Satellites of that type within the asset class could tend to improve overall performance of the portfolio by helping to reduce both the downside volatility and investment losses. All of this is aimed at producing the desired result illustrated in Figure 1 – “higher lows” in down markets, as well as “higher highs” in up markets.

Because Satellites, by design, are intended to help a portfolio adapt to changing market conditions, they may be changed more often and rapidly than Core funds/managers. Because of this, the performance parameters and weightings used to score and rank Satellite funds/managers need not be identical to those used to score and rank Core funds or managers and may be designed to be potentially more time sensitive to changes in the investment environment of the asset class.

The speed with which changes in relative rank will take place will be directly dependent upon how much weight is assigned to shorter-term performance parameters as opposed to longer-term parameters. Greater weight on shorter term performance parameters will tend to produce steeper and more rapid declines in the relative rankings of mutual funds and managers not adapting well to the then- changing market conditions. There is, however, no “one size fits all” approach or strategy in this – and, looking ahead, one is certainly not being suggested here. On the contrary, more aggressive investors (with more aggressively designed and configured portfolios), may well wish to build in a greater degree of sensitivity to changes in sector/style performance within various asset classes. More conservative investors may wish to have fewer or no Satellite positions at all.

Core / Satellite Blending of Strategic and Tactical Asset Allocation

Prior to our experiences in the 2008 / 2009 Crash, if asked our position in the ongoing strategic versus tactical allocation debate, we would have said that “we believe in strategic allocation and do not advise trying to time the markets by attempting to tactically allocate.” We felt that “tactical allocation” was most appropriate at the money manager level. Managers with demonstrated tactical allocation skills (e.g., deciding which sectors to over-weight and which to avoid) were one of the skills that would result in their rising to the top of our rankings. In that way, our periodic decision technology-based scoring and ranking of managers did incorporate a tactical allocation effect – albeit limited to tactical manager-related shifts within broadly defined strategic asset classes.

We still believe that attempts to tactically allocate / time the market at the client or investment advisor level are very difficult and generally unwise. Nevertheless, we believe the use of the Core / Satellite structure described above could prove useful. It takes our belief in tactical allocation at the manager level, and explicitly recognizes and implements it in Satellite manager selection. Using broader asset class definitions, allowing narrowly niched sectors and styles, allowing broader ranges of volatilities, and potentially increasing the emphasis on shorter term performance parameters, will produce “tactical” mutual fund and manager shifts. This can and should be expected as sectors/styles come into and lose favor within the asset classes in which Satellite managers are positioned.

We believe the strategic-versus-tactical allocation debate tends to foster the misimpression that the choice is between two mutually exclusive approaches. But, to us, they do not appear to be mutually exclusive. We believe that each has its own distinct advantages, and that our “Core / Satellite” strategy accomplishes a unique[iv] and very practical blending of the best aspects of both.

Our Core/Satellite Strategy facilitates portfolio rebalancing

For many investors, the traditional rationales or periodic re-balancing – reallocating investment assets from asset classes that have outperformed to those that have under performed – while appearing logical, also seems counter-intuitive. Although appearing to result in “selling high” and “buying low”, it also seems to result in rewarding poor performance while penalizing superior performance.

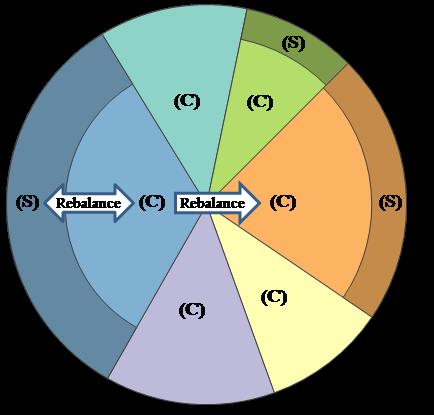

Our Core / Satellite Strategy helps to address this objection and resulting client reluctance to re-balance in two uniquely important ways. In any asset class in which there is a Core / Satellite structure, one manager will, at any given time, typically be outperforming the other. As a result, the better performing manager (whether Core or Satellite) will come to manage a greater percentage of the investment assets within that class. This will, in practical effect, produce an automatic daily “dynamic reallocation” between the Core and Satellite managers within the class (as illustrated, in Figure 6 below, by the white double pointed arrow within the blue wedge). This growth effectively rewards the better performing manager with a higher percentage of assets within the class while the poorer performer is penalized by having its share of the assets reduced relative to the other – not vice versa as in traditional re-balancing scenarios.

But what about rebalancing between asset classes? Here, too, our Core / Satellite strategy offers a unique and intuitively satisfying solution. As described above, in an asset class with at least one “Core” and one “Satellite” manager, one will tend to outperform the other over time – and this effect can be expected both in asset classes that are growing and those that are declining in relative value. This phenomenon creates a unique opportunity for rebalancing between asset classes that does not necessarily involve rewarding the poorer performer and penalizing the better performer.

If, for example, the asset class represented by the blue wedge, had grown disproportionately large relative to the asset class represented in orange, and a rebalancing of assets from the blue class to the orange one is desired, we would have a number of choices as to how this could be done. Funds from the blue Satellite could go to either the orange Core or Satellite, or from the blue Core to either the orange Core or Satellite. Most might choose to transfer assets from the poorer performer of the two blue asset class managers to the better performing of the two orange asset class managers.

Notes regarding how to practically apply our Core/Satellite Strategy

Prior to the creation of our Core / Satellite Strategy, all client portfolios in which managers/mutual funds had been selected through the use of our decision-assistance technology (and with broadly defined asset class definitions), could now be considered to be 100% Satellite portfolios.[v] In the extreme stress test provided by the 2008 / 2009 Crash, these 100% Satellite portfolios did in fact adjust to changing market conditions. But, they did so with varying time lags. The lengths of such lags were largely dependent on the degree of weight placed upon shorter-term versus longer term performance parameters. The demonstrated ability of 100% Satellite portfolios to adapt to changing market conditions would tend to support the conclusion that they might well be the preferred portfolio configuration for those clients wishing the maximum of composite investment effects in both up and down markets. But, in order to truly do so with less of a time lag through transition periods, one might need to place a greater emphasis on shorter term performance parameters.

The highest scoring funds resulting from the factor weightings used in our decision-assistance technology have quite often tended to be “outliers” – those with composite performance that is truly exceptional. Top scoring managers in up markets often tended to be those with higher volatilities than average for their asset classes, but often with much higher average returns. In contrast, in down markets, the top scoring managers often tended to be those with significantly less than average volatility and losses. Yet, missing between these two desirable extremes is anything in the middle.

While employing 100% Satellite portfolios to try to maximize the performance potential of each asset class may well be a useful and desired strategy for investors who are very aggressive or very conservative, that strategy may not be optimal for those whose investment goals are more moderately positioned. For example, the Investment Policy Statements of many institutional portfolios are quite often found to have descriptions of performance goals stated in the following general way: “we wish to meet our actuarial target” and “exceed the returns of our benchmark indices” (often by no stated margin). Moreover, risk tolerance is often generally expressed in terms of a desire to minimize the chances of losing principal and, more specifically, it is sometimes expressed as a desire to have overall portfolio and manager volatilities not substantially exceed their benchmark indices.

Interestingly, for such clients, maximizing the return potential of their portfolios is typically not the goal. Instead, their goal is to achieve the needed level of returns without exceeding the general average risk exposure of the portfolio allocation – a more moderate “middle path” that 100% Satellite portfolios may not be well designed to produce. Are there individual investors that might have similar, more moderate investment goals? We believe there are. And while more equally balanced weightings structures in our manager selection process might well have produced Core-like mutual funds and managers for such clients, adoption of an expressly designed Core / Satellite (or even all Core) strategy would appear to leave less to chance in ensuring that appropriate managers are selected.

In making this important distinction, it is also important to understand that, unlike the passive Core strategy, in which the Core investment never changes, what is being employed here is an “active Core” strategy, in which managers will change. Because Core manager selection also makes use of our patented decision-assistance technology, here too mutual fund / manager selection is dynamic. As market conditions change, Core manager rankings can be expected to change as well.

It is also quite important to understand that adding a Core component to any asset class will, by definition, tend to moderate the investment results of that class in the following significant ways. For aggressive investors, adding a Core component will tend to proportionally reduce the upside return potential of the asset class. It could also tend to proportionally reduce the volatility and loss potential of the asset class (perhaps especially in transition periods). Conversely, for conservative investors, adding a Core component will tend to increase the return potential of the asset class and, to some extent, perhaps its volatility/risk as well (as the “risk budget” of the class is more completely used).

The percentage allocations between Core and Satellite can vary quite widely in order to best meet the needs and goals of individual clients and may vary further between asset classes for the same client. Some clients may decide that a Core / Satellite structure makes sense for them in only one or two classes, while others may wish such structures in all or none of their asset classes. The ability of the advisor and client to select the percentage of any asset class to invest in a Core versus a Satellite mutual fund or manager – the ability to blend the two, from a very small proportionate exposure to the Satellite to a very large exposure – gives a new range and level of control. And that blend can also be modified over time as the markets and the investment goals and preferences of the client change.

There simply is no “one size fits all.” Core / Satellite structures are not necessarily for every client and should not be employed automatically. As stated earlier, our Core / Satellite Strategy was designed in a period of significant market uncertainty following the worst investment losses in decades. It was designed to dampen overall portfolio volatility, especially downside volatility, while not “unduly” dampening the upside potential of client portfolios.[vi] It is important to take the time to think through the advantages and limitations of this new design technique, to ensure that, if and to the extent that it is implemented, it truly matches the client’s needs and goals.

Conclusion

At no time in the memory of all but perhaps the oldest living investors, have investment losses been as severe as those experienced in the 2008 / 2009 Crash. But, the current even more dramatically rapid market declines are reminders of that period and prompt us to look back at lessons learned. What lies ahead could ultimately be an equally dramatic, time-compressed rebound. But, until then, the possibly exists of even more severe losses. Only “time will tell.” We believe this unique Core / Satellite Strategy will help advisors and their clients be better prepared for either eventuality.

We viewed the development of our patented Core / Satellite Strategy during that especially trying period as an important breakthrough. Coming at a time in which investor anxiety and uncertainty was still high and tolerance for additional investment losses was quite low, this strategy helped to instill a great sense of confidence and control in both advisors and their clients. It kept many from making ill-considered, precipitous moves into non-diversified, “all cash” positions that compounded losses in value as markets began to rise. The risk of such non-diversified, all-cash positions may be even greater if the ultimate recovery from current market drops is as rapid as those drops have been.

During the patent application process, our back-testing focused on the entire 18 months of the 2008 / 2009 Crash, a period with no positive quarters. We found that the application of a 100% Core strategy (described above) outperformed all other available manager selection methodologies known to us, including: passive / index-based investments, 100% “Satellite” selection methodology (using our patented decision-assistance technology for Satellite manager selection), as well as blends of the Core with Satellite selection.

Decision Technologies Corporation is pleased to now be introducing this patented “Core / Satellite” portfolio design capability and the patented decision-assistance technology on which it is built. With it, advisors will have an additional, practical way to enhance both mutual fund and manager selection by further “fine tuning” risk exposures of their clients’ portfolios through these enhanced design and selection methodologies in both up and down markets.

[i] “Classical” portfolio design starts with ascertaining a client’s tolerance for risk and then aims to design a portfolio that optimizes potential returns at that level of acceptable risk – in other words, the design of portfolios is classically “risk driven.” In the application of our “Core/Satellite” design methodologies, we begin in the same way.

[ii] Their lower volatilities, which had often appeared to be a cause of significant underperformance in prior up-market periods, were now often producing better than index returns in then current down-market periods. Exceptional managers in up markets were, in many cases, unable to adapt quickly enough to down market conditions (or unable to adapt at all).

[iii] Sometimes a normal, unconstrained scoring and ranking will produce a result in which the highest ranked managers are also very close to benchmark index volatilities and have investment holdings reasonably consistent with that of the benchmark as well. In such cases, the resulting managers could, in practical effect, be considered “Core” managers despite the fact that their selection did not result from a “constrained search” – such a search, in that case, being unnecessary as the results would (in the event it were to be performed) produce essentially the same result.

[iv] We believed our “Core/Satellite” strategy to be available nowhere else, and that it was sufficiently unique and valuable to merit the filing of an additional patent application. The granting of that patent confirmed our belief.

[v] An arguable exception to this perhaps overly broad generalization would be that, in practical effect, the performance parameter weightings used for conservative and risk-averse clients might well have tended to produce manager rankings similar to what might have been produced through the application of the “Core” manager selection methodology described above.

[vi] Nevertheless, they will have the tendency to dampen the upside potential of aggressive portfolios and may also tend to increase the risk of extremely conservative portfolios.

Eric Smith, J.D., is also the President of Trustee Empowerment & Protection, Inc., a registered investment adviser, which is providing reviewing consultant services to better protect the trustees of pension and health & welfare plans in their investment-related decision making and to help improve plan investment results. He can be reached at: esmith@TEPI.tech // 248-797-0500.