Solutions

Cloud Comparison Engine for Professional Advisors

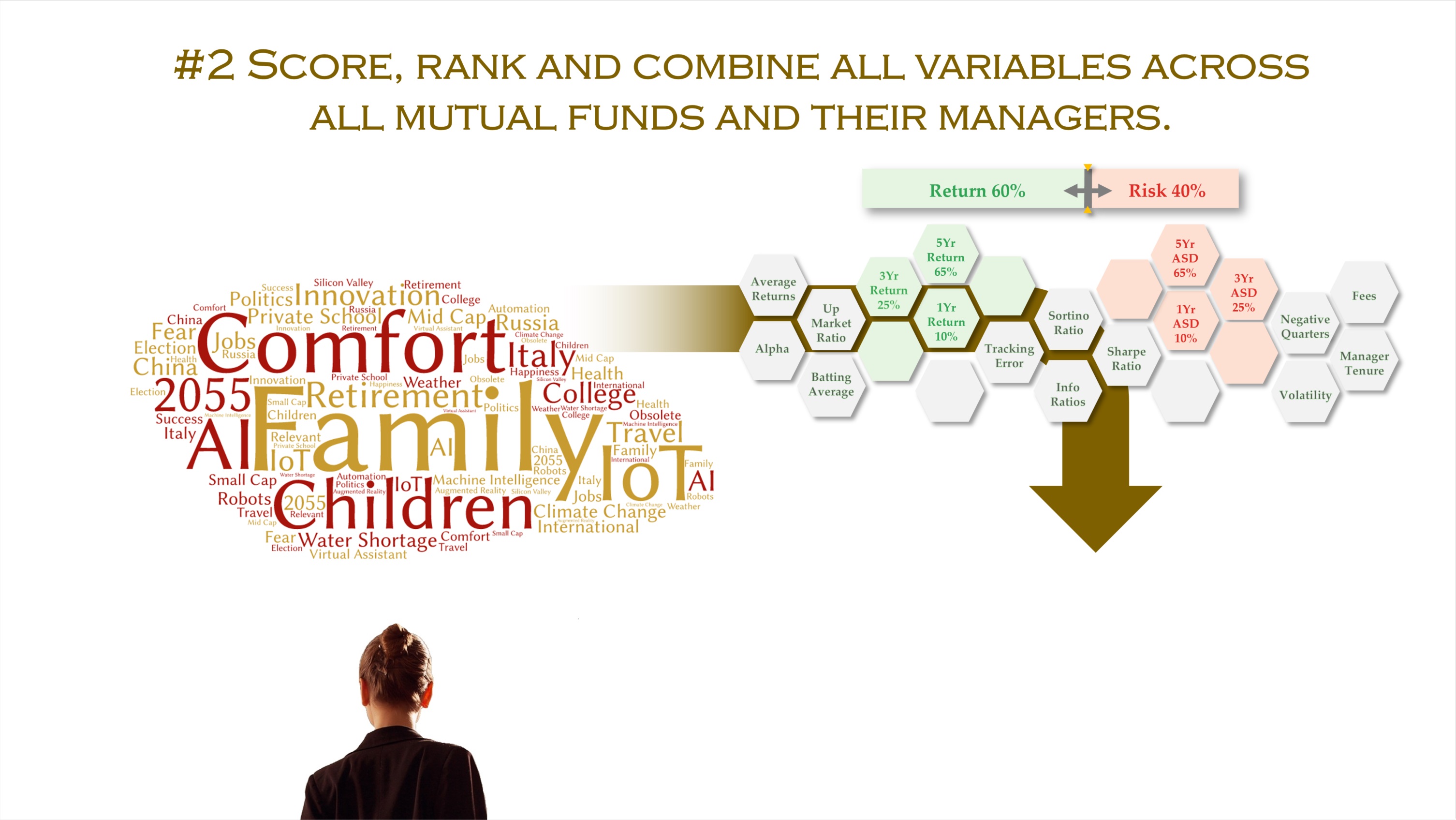

- DTC’s patented comparison engine incorporates multiple risk factors and parameters, in a manner your clients can completely personalize.

- Your clients are enabled to score and rank thousands of investment choices, using weighted blends of multiple performance parameters.

- Your clients can now objectively improve their investment selections and portfolio creation without the sales pressure of mass marketed financial products.

APIs for Robo Advisors

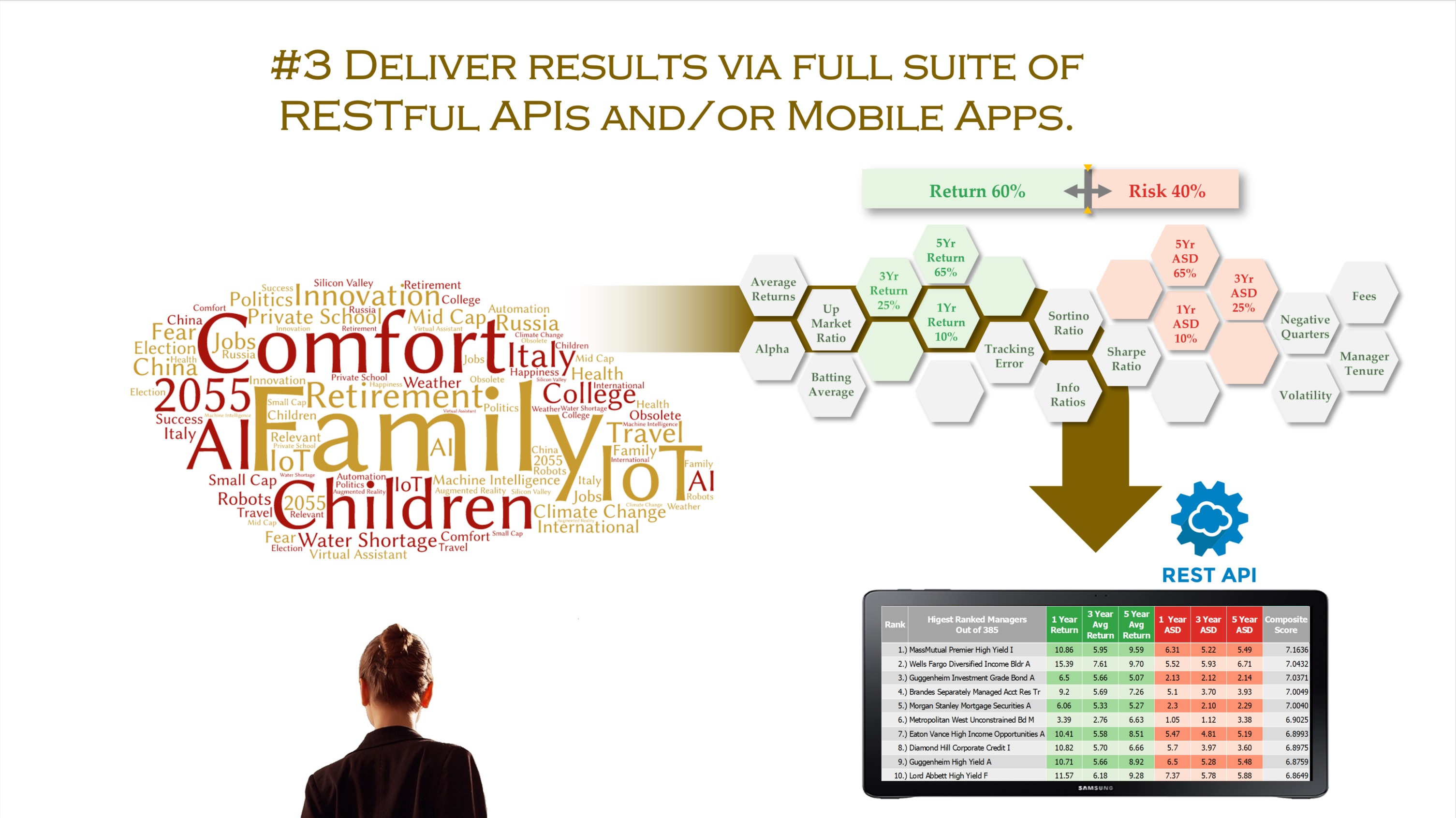

- Communicate with an API that incorporates multiple performance factors based on the personalized preferences of your clients.

- Leverage DTC’s APIs to comparatively score and rank thousands of investment choices based on historic performance.

- Periodically access the APIs so your clients can continue to evaluate their investment choices against the top scoring alternatives in each asset class.

Financial Service Facts – How would you choose?

Our Mission

To empower investors to make better decisions using personalized scoring and ranking methodologies, so that investors can visualize and understand which investment management teams are performing the best within any given asset class.

To advance the financial industry that has for decades quantified investments by solely using single performance factors such as Sharpe and Sortino Ratios, Mean Variance Optimization and other algorithms / factors / ratios / processes.

To create financial product awareness and accountability for families across the world.

Our Process is Patented

We began by scoring and ranking mutual funds, ETFs, money managers, life insurance and other financial products. On May 4, 2010, we received U.S. Patent 7,711,623 B2 for our decision-assistance process.

In response to the high volatility of portfolios during the market crash of 2008, we implemented a Core-Satellite technique into our decision processes to reduce portfolio volatility. On December 25th, 2012, we received U.S. Patent 8,341,060 B2 for our Core-Satellite design methodology.

We have been awarded 9 foreign patents for our decision assistance process and methodologies.

Latest News

CORE / SATELLITE PORTFOLIO DESIGN METHODOLOGIES U.S. PATENT NO. 8,341,060 B2

Decision Technologies Corporation Trustee Empowerment & Protection, Inc. March 30, 2020 Report Abstract Our patented Core / Satellite strategy was designed to help fine tune overall portfolio risk exposure / volatility – optimizing the portfolio’s risk/return profile.This report provides summary description of the strategy together with the rationales and techniques needed to implement it. Introduction / Overview During the 2008 / 2009 Crash we observed that an extraordinarily high number of active managers (far more than usual) had underperformed benchmark indexes in their respective asset classes. As downside volatility surged, the volatility of active managers (the holdings of nearly all […]

Selling Low and Buying High – How Crises Turn Investment Principals Upside Down

March 23, 2020 By Eric S. Smith, J.D. The current situation is much different in cause but similar in effect to the 2008 / 2009 Crash, and the eventual recovery may be much different as well. Much like the 2008 / 2009 Crash, the recent sell-off has generated multiple dire predictions, with a resulting surge in gloom and doom reporting. Now, like then, all of this has led to escalating investor concern, with many investors fearfully rushing to “get out” of the equity markets. News channels are now filled with “expert” commentators telling viewers that “this is not like the […]

Pension Trustees – ARE YOU PREPARED? / A LESSON FROM THE LAST CRASH

March 23, 2020 The timing of the Article “Are You Prepared? / A Lesson From the Last Crash”, written by Eric S. Smith, J.D. on November 10, 2019, appears to have been clearly “prophetic” in its intended protective effect in view of the current dramatic market conditions. When this message was first written, toward the end of 2019 and in the first two months of 2020, stock markets were at all-time highs. There was, however, a growing concern that another crash might be coming, but few then could have guessed its current cause and severity. The last crash devastated Taft-Hartley […]