March 23, 2020

By Eric S. Smith, J.D.

The current situation is much different in cause but similar in effect to the 2008 / 2009 Crash, and the eventual recovery may be much different as well. Much like the 2008 / 2009 Crash, the recent sell-off has generated multiple dire predictions, with a resulting surge in gloom and doom reporting. Now, like then, all of this has led to escalating investor concern, with many investors fearfully rushing to “get out” of the equity markets.

News channels are now filled with “expert” commentators telling viewers that “this is not like the 2008 / 2009 Crash,” that “this is different,” as though lessons learned (or least those we should have learned) then do not apply now. The obvious differences obscure one very important similarity that many of those who have sold and left the markets may fail to realize before it’s too late to avoid compounding their losses. That similarity is the growing amount of cash on the “sidelines” and the effect that it will have when it starts to move.

The danger for those who have sold off their equity, bond, and other investment holdings, and have now moved into mostly or all cash, is that many of these investors fail to understand that they have moved into a non-diversified portfolio and fail to realize significant risks of doing so.

Cash, which in 2008 / 2009 and for the greater part of the last several weeks proved to be one of the best investments, may well become one of the worst investments moving forward. With short-term government interest rates now (like then) at near 0% (with recent Fed action), as interest rates begin to rise (and at some point they certainly will), there will be no direction for the value of Treasuries, cash, and other “cash equivalents” to go but down.

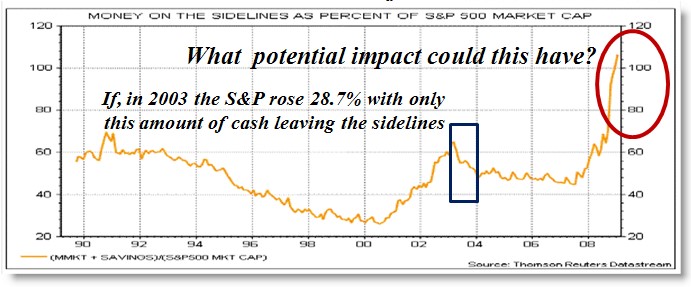

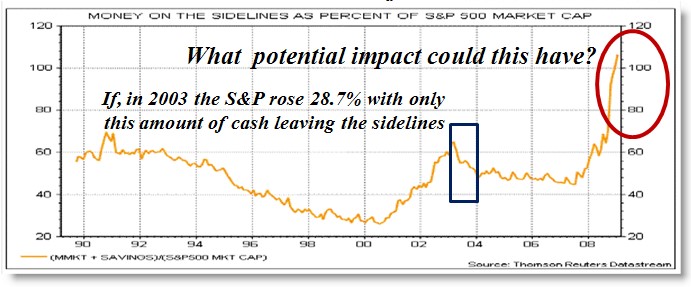

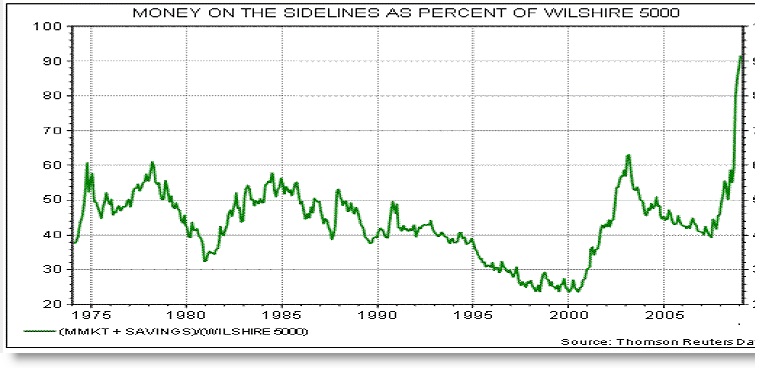

What’s now happening bears a striking resemblance to what the situation was in March of 2009. The amount of cash on the sidelines (in early March 2009) was nearly 104%+ of the entire capitalized value of all of the S&P 500 constituent companies – and, just to put that number in additional perspective, that was equivalent to 93% of the entire market value of the Wilshire 5000 (nearly the complete cap value of all domestic public companies). Nothing like that had occurred in the previous 20 years and possibly longer. What does the fact that it’s now recurring after an exceptional 10-year bull market portend for the degree and speed of the recovery to come? At least one lesson should now be clear.

When that cash begins to leave the sidelines, it will have to go somewhere. Whether it will go into equities, commodities, or real estate, the price of those particular assets will inevitably rise and the relative value of cash will fall.

Cash is simply another financial asset that needs to be “managed” every bit as much as any other asset classes comprising an investor’s portfolio. To better understand this, one need only look at the practical effect of what happened during the 2008 / 2009 Crash. As markets dropped, the value of cash nearly doubled relative to equities. This is now happening again. However, when the equity market more than doubled in the wake of 2008 / 2009, the value of cash (again, relative to equities) declined by over 50%. It took twice as much cash to buy the same stocks.

What 2008 / 2009 taught us, that we believe that too few investors fully understand, is this:

If you have any assets at all, including cash, you are “in the game,”

and there is no way to “get out.”

There really is no “safe investment.” All financial assets – stocks, bonds, commodities, oil, gold, jewelry, art, real estate (including one’s own home), and even cash, are all subject to both declines and appreciation in value. In reality, there is no “getting out” – no way to “move to the sidelines” into some “safe” asset, to “wait things out.” Short-term maybe, but longer-term no.

If cash is viewed as “an alternative to investing” (i.e., if a move to cash is viewed as “being out of the market”), this point gets entirely missed. But, if cash is regarded as an asset class / as a part of a complete portfolio, then the situation is entirely different and, consequently, potential responsive strategies are as well.

If cash is viewed (as it is now) as an overly appreciated asset class, classical portfolio theory suggests that re-balancing should occur. Yet, it’s a strategy too many investors may overlook to their potential harm. Without re-balancing, the investment losses that an investor may have sustained before moving into cash could be compounded by additional losses as the value of that cash decreases relative to other financial assets into which that cash could have been invested. Only diversification (with periodic re-balancing) can provide some meaningful degree of long-term safety.

Trying to time the market recovery – when to “re-balance” – may be even more difficult this time. While the feeling of “safety” in moving to all cash may ultimately prove to be a cruel illusion, the belief that one will be able to accurately time when to “get back in” (so as to not miss the upturn), might prove even crueler. Why? Because the market recovery this time might be so rapid as to cause many investors to miss the benefit of it or at least much of it. Here’s why.

The causes of the 2008 / 2009 Crash were structural, triggered and made worse by the cumulative effects of growing abuses and unsound practices within the financial markets. In contrast, the cause of the current market selloff is entirely unrelated to the financial markets and the fundamental, pre-crisis economic health of the country. It’s also different in the speed at which it has occurred.

It took 18 months of declines to produce the record losses in 2008 / 2009. We’re now approaching such losses as little as 18 days . . . a rate of speed 30 times greater than in 2008 / 2009. Both differences may mean that the eventual recovery could also be dramatically different.

Remedying the underlying causes of the 2008 / 2009 Crash took structural changes, new legislation, new regulations, fiscal and monetary reforms, etc. All of that took time, roughly the same amount of time for investors to see such changes and for their confidence to grow to the extent necessary for the markets to recover . . . a recovery that took over two years. However, in the absence of some dramatic damage to the country’s economy (from the policies now being put in place), the removal of the single cause of the current market downturn could have a dramatic effect. Much like current losses occurring at a rate 30 times faster than during the 2008 / 2009 Crash, it would seem entirely possible for a recovery to take place at that same accelerated rate.

The danger for those who have sold off their equity, bond, and other investment holdings, and have now moved into mostly or all cash is that the recovery, this time, may come so quickly as to compound the losses incurred in “getting out” and moving into cash.

So, what about “getting out of the market” (i.e., moving to cash) now? For the reasons discussed above, now would seem to be a particularly risky time to move into an “all cash” position – with cash at a very high value relative to other asset classes. Moving out of other investments (at new lows) and into cash (now at a very high value relative to other investment assets) would, in effect, be “selling low” and “buying high” – exactly the opposite of the fundamental “buy low” and “sell high” principle upon which all sound investment strategies are based. The “best” time to have moved to “all cash” may now be past.

What about those who have already “gotten out of the market?” We believe that most of those who have already made the move to “all cash” positions have done so in the mistaken belief that they are now “safe” from further investment losses. We also believe that losses they may have incurred in moving to cash could be “compounded” by losses in the value of the cash they are holding may not have occurred to most of them. So, understanding that “cash” is simply another investment that can in fact decline in value (potentially significantly), and that the risk of such losses can be lessened by diversifying (i.e., re-balancing), is increasingly important.

We are not necessarily suggesting that an immediate, all-out, “full re-balancing” is now required. We believe that the pace of such re-balancing needs to be left to each individual investor but suggest that re-balancing should be systematically timed. Rather than trying to time such re-balancing to catch ultimate market lows (which, in most cases, will prove to be a practical impossibility), periodic re-balancing, but now at more frequent intervals (or on market dips) may make sense.

The importance of reassessing your current investment position and strategies now. The surge in market volatility and severe market drops of the last several weeks have not only “stress tested” portfolio designs, investment selection methodologies, and each individual investor’s tolerance for risk, they have evoked understandable but potentially harmful “emotional responses.” We believe there is now an immediate and growing need for a review of each of these areas – especially with the prospects of a potentially dramatic recovery and considerable lingering uncertainty.

We hope investors will take advantage of this opportunity to secure help in a review of their portfolios, especially their investment selections – to help ensure that while working to reduce downside risk they are not unduly limiting their portfolio’s upside potential. Now would be a great time to do so.

Eric Smith, J.D., is also the President of Trustee Empowerment & Protection, Inc., a registered investment adviser, which is providing reviewing consultant services to better protect the trustees of pension and health & welfare plans in their investment-related decision making and to help improve plan investment results. He can be reached at: esmith@TEPI.tech // 248-797-0500.

© 2020 Trustee Empowerment & Protection, Inc. All Rights Reserved